Heloc poor credit

The APR will not exceed 18. Why Flagstar Bank is the best home equity loan for flexible loan terms.

Minimum Equity Requirements For Heloc

The average rate for a 10-year 30000 home equity loan currently sits at 705 The average credit card interest rate is 15 but many times consumers find themselves with.

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

. A home equity loan can be a great way to borrow money at a low cost to fund home improvements or consolidate debt. Consumers with low credit scores will likely have the best chance of being approved for a cash-out refinance loan backed by the FHA Federal Housing. The more equity you leave in your home the better your HELOC rate will be.

Heres how youd calculate the maximum home equity loan on a 350000 home with a 250000 loan balance and an 80 LTV ratio. We currently have about 35k in savings and. For our income level thats quite affordable.

As of 08302022 APRs for Home Equity Loans range from to. However because of your poor credit score you may have to pay a. Getting a home equity loan with bad credit requires a debt-to-income ratio in the lower 40s or less a credit score of 620 or higher and home value of 10-20 more than you.

A home equity loan is a secured loan where borrowers get money based on the value of their home and how much equity they currently have. With negative credit borrowing money will be more difficult but being accepted for a HELOC is feasible. A debt-to-income ratio is the total of all debts you pay monthly divided by the gross monthly income.

New American Funding HELOC Be the first to rate Visit Site Loan Amount 25K Starting Loan Amount APR 350. But if you have bad credit FICO score below 580. Multiply your homes value by 080 80 2.

Lenders will usually offer you. If you are considering a HELOC loan with bad credit below are key reasons you need to get a. A home equity line of credit is a type of second mortgage that allows homeowners to borrow money against the equity they have in their home and receive that money as a line of.

Terms range from 10 to 20 years on loans from 10000 to. Other rates are available for other loan. This can make using this option.

If you have a 1000 monthly mortgage payment along with a. Here is SuperMoneys list of the best HELOC lenders for bad credit. When you take out a HELOC while having bad credit one of the most important risks is that you probably wont secure the best interest rate.

Taking out equity with a home equity line of credit can be a smart financial move in many cases. The rate will be at around 55 on the HELOC and come out to around 170 a month for 10 years. APRs start at 653 percent in some states.

Loan terms can range from 5 years to 30 years. There are a number of factors that determine home equity line of credit rates.

Home Equity Line Of Credit Heloc Loan Canada

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

How A Heloc Works Tap Your Home Equity For Cash

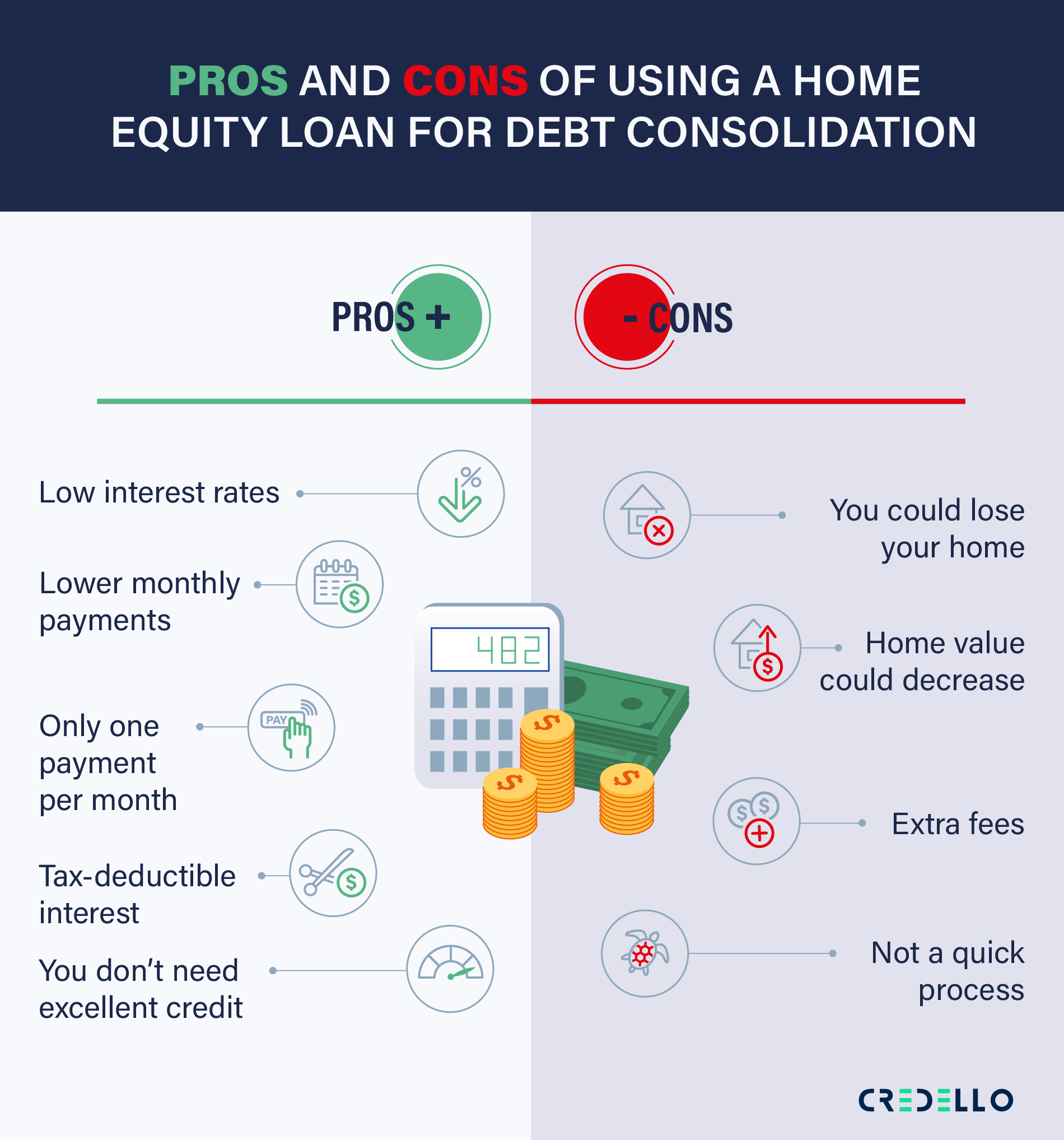

Should You Use A Home Equity Loan For Debt Consolidation I Credello

Second Mortgage Loans Vs Heloc Mortgage Central Nationwide

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Minimum Equity Requirements For Heloc

Can You Get A Heloc With A Bad Credit Score Credello

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

Home Equity Line Of Credit Heloc Loan Canada

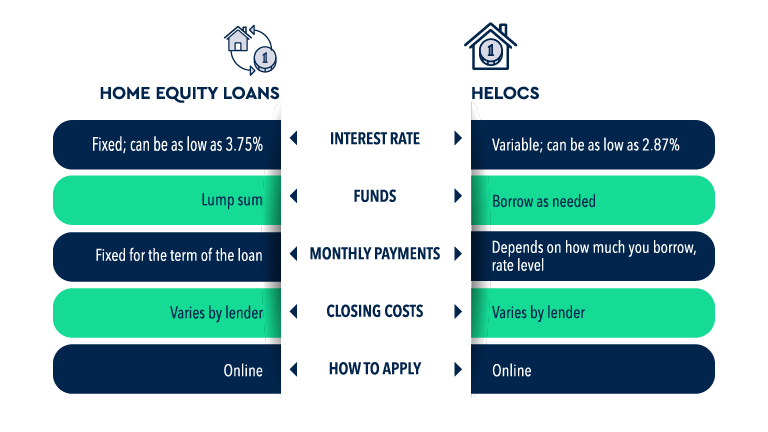

Home Equity Loan Vs Home Equity Line Of Credit Your Equity

How To Get A Heloc With Bad Credit Easyknock

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet